The hobby of collecting sports cards continues to grow while sports card investing has seen a huge increase over the past few seasons. With the right sports card investing strategies, a thought-out blueprint, and reasonable decisions, sports card investing can both be exciting and rewarding. Once a hobby of filling nine pocket sleeves in a loaded sports card binder to show and trade with friends has once again found a way for individuals looking to add physical valuable assets to their diversification portfolio.

Now if you are sports card collector, you already understand the hobby as well as how sports cards can return solid Return on Investment (ROI) profits. If you are new to the hobby as either a collector or someone looking to invest in sports cards, the one question you may have is “why is investing in sports card both realistic and profitable”.

Before we get to some key sports card investing strategies, remember like any other investment you decide to make, nothing is guaranteed. Take time to research, learn, and understand the hobby. Our Beginners Guide to Sports Card Collecting is a great starting point for anyone just getting into the hobby.

Why Invest in Sports Card?

If you look around the world, professional sports continue to grow in popularity across a wide range of sports including soccer, American Football (NFL), basketball (NBA) and baseball (MLB). Add in nearly everyone’s love to make money and it opens the door for sports card collectors to take advantage of it. In addition to sports becoming more popular, sports gambling and daily fantasy sports continues to grow bringing in new collectors and investors into the hobby. Lastly, the attention brought to hobby with sports card sales in the millions including a Tom Brady Rookie Card selling for over $3 million dollars.

All this excitement and buzz has driven the sports card market to see values never seen before within the hobby. These values include modern sports cards as well as vintage cards along with Autographed Sports Cards and Graded Sports Card carrying the higher selling prices. Furthermore, sports cards come in a wide range of products as well as offering products that can have low quantity print runs and availability making them harder to obtain. Like coins and other collectibles, products that are scarce will add to the value of the item.

Lastly, as investing in sports cards was once performed by the collector but that is not the case anymore. Investors looking to make profits in other trends such as the stock market and reality have also transitioned to investing in sports cards. Sports cards have become an investing option that can be lucrative which increases the quantity of individuals ready to spend the money. Luckily for you, we have some Sports Card Investing Strategies to help you get started or alter the way you invest today.

What made Sports Card Investing grow?

There are a lot of key reasons why sports cards have become extremely popular and more then the buzz we saw during the early 1990’s sports card craze. Here are a few things that made sports card investing grow:

Sports Card Grading Impacts Sports Card Investing

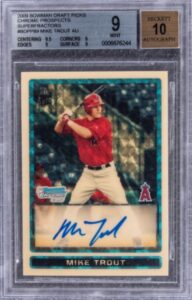

With the growth of sports card grading from companies such as Beckett Grading Services (BGS), PSA, SGC and CSG, the ability to know if the card is authentic, is reality. In addition, these following companies hand out grades on a 0-10 card grading scale allowing individuals to find cards that are in Pristine or Gem Mint condition. The difficulty and rarity of higher graded cards, help increase the value making it more appealing to someone looking for ROI in the future. Furthermore, most of the top sports card grading companies offer population or “Pop” reports to allow both investors and collectors to know how many of a specific card was graded a specific grade.

Technology Impacts Sports Card Investing

A second thing that has increased sports card investing is technology. Now with the world at the tip of our finger, everyone has a chance to learn, invest and make money on the fly without having to leave your home. Heck, you don’t even have to leave your bed if you don’t want. With today’s technology, sports card investors can learn the hobby, purchase potential investments, and sell very easily. Sites such as eBay and Check Out My Cards (COMC), deliver extensive sports card marketplaces to investors while Facebook communities open additional avenues.

Sports Card Box Breaks and Case Breaks Impacts Sports Card Investing

Lastly, the introduction and growth of sports card box breaks and case breaks now allow collectors and investors an opportunity to invest in products from a specific product without having to purchase an entire box or case of that product. For example, 2022 Bowman Baseball has arrived, investor one purchases the New York Yankees for $100. The company sells all teams, and the box or case is then opened online. All Yankee cards are rewarded to the investor of the Yankees including any autographed or rare cards from that team.

Sports Card Investing Strategies

Like with any item you can invest in everyone has their own set of investment strategies they tend to stick with. While we don’t guarantee our sports card investing strategies and recommend you take the time to understand the sports card investing risks, we do have a few that can help you along the way.

Vintage Card Investing

One of the best sports card investing strategies you can consider is to invest in vintage sports cards and more importantly vintage graded sports cards with high grades. Vintage cards from the 1950’s to even the mid 1980’s depending on the product were not collected in today’s times with the same card collecting supplies and techniques. That said, lower quantities are available of these products and even lesser higher graded vintage cards are available. Take the time to learn Sports Card Grading and how it can benefit you when it comes to vintage sports card investing.

Sports Card Graded Investing

Another strategy is to consider investing in graded sports cards that have already received a number grade. Knowing you purchased a Pristine 10 Mike Trout Rookie Card over purchasing an ungraded Mike Trout Rookie card can guarantee you didn’t waste money on a card that may grade a 8.5 or 9. Yes, higher graded cards cost more but when the market increases, these cards tend to see a higher increase in value over lower graded cards.

A second way you can invest in graded sports cards is to look at cards graded by PSA that may be graded a 9. Purchase the card, open the case (very difficult and can damage card), resend card out to BGS for grading, hope it comes back at a higher grade such as a 9.5 and then resell the card. Yes, it sounds difficult and time consuming, but the reality is that this has been seen and done time over time.

Event Or Milestone Sports Card Investing Strategies

Just think how popular the NFL Super Bowl is or the FIFA World Cup are when it comes time for them to begin. Now take this same approach, but six months ahead of time you elect to invest in a bunch sports card from some of the most popular soccer teams that are involved in the World Cup. Boom the World Cup kicks off and one of those players scores a goal. Here is your opportunity to sell the card at a much higher value without having to hold onto the card for the long haul. This allows you to reinvest and restart with another event or milestone.

Popular milestones could include a player reaching 3000 hits such as Miguel Cabrera did during the 2022 MLB season, or a player reach a total point total for career such as LeBron James is slowly approaching in the NBA. Popular events could include the World Series, the NBA Finals, the FIFA World Cup and the Olympics. Other impactful items could be the release of a sports movie or documentary such as The Last Dance focusing on the Chicago Bulls and Michael Jordan.

Each of these create additional buzz which will help increase the value of the cards you have invested in. Avoid purchasing for cards during these same times as cards will see an increase in value.

Prospect/Rookie Sports Card Investing Strategies

The last of the sports card investing strategies is investing in prospects before the arrive at the Major League Level. Prospect investing is majority related to Major League Baseball products including the popular Bowman Baseball brand. Bowman baseball offers collectors and investors access to players who were drafted and are in the minor leagues prior to joining the Major Leagues.

Top overall draft picks tend to have high price tags despite being a prospect such as we have saw over the years with the likes of Manny Machado and Bryce Harper as well as the likes of Julio Rodriguez and Bobby Witt Jr the past year. While top stars are difficult to invest in due to the higher risk of profit losses, the option is there. However, looking at prospects who come out of nowhere who put together big seasons can result in huge profits as well as potential long-term value.

In addition to prospect investing, rookie sports card investing is the option to invest in rookie cards of players who were drafted within the most recent draft with the hopes of them becoming the next Michael Jordan or Tom Brady. If you invested in Brady after he was drafted, the value of the cards were pennies on the dollar while a recent Contenders rookie auto sold for over $3 million dollars. Much like prospect investing, top overall draft picks have higher initial investment prices. In the NFL, quarterback rookie cards bring top value.

Do you have any sports card investing strategies you like or would like us to follow up on? Let us know.

5 Comments